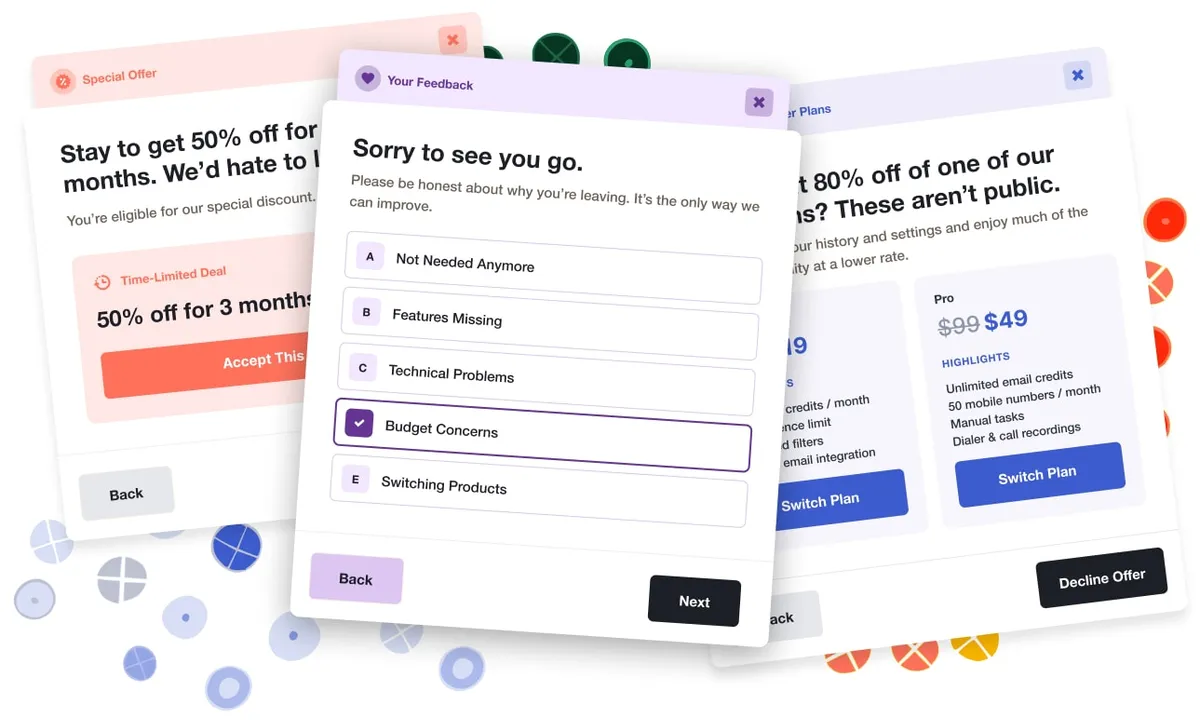

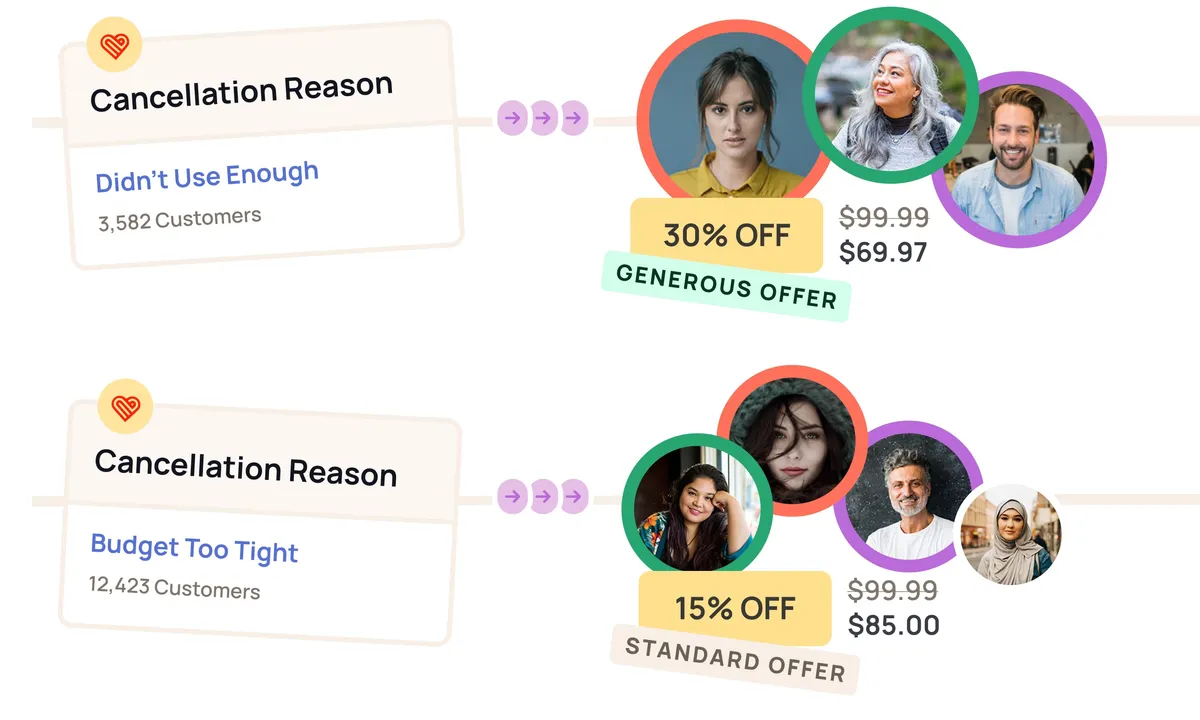

Churnkey is a comprehensive customer retention platform designed to empower businesses in reducing churn and optimizing growth. With a mission to simplify and automate the complex landscape of customer retention, Churnkey offers a suite of tools that address key challenges faced by customer-obsessed teams. The platform boasts personalized cancel flows, minimizing cancellations by up to 51%, and advanced payment recovery features, reclaiming up to 89% of failed payments. Leveraging artificial intelligence, Churnkey streamlines customer feedback analysis, facilitating data-driven product development at scale.

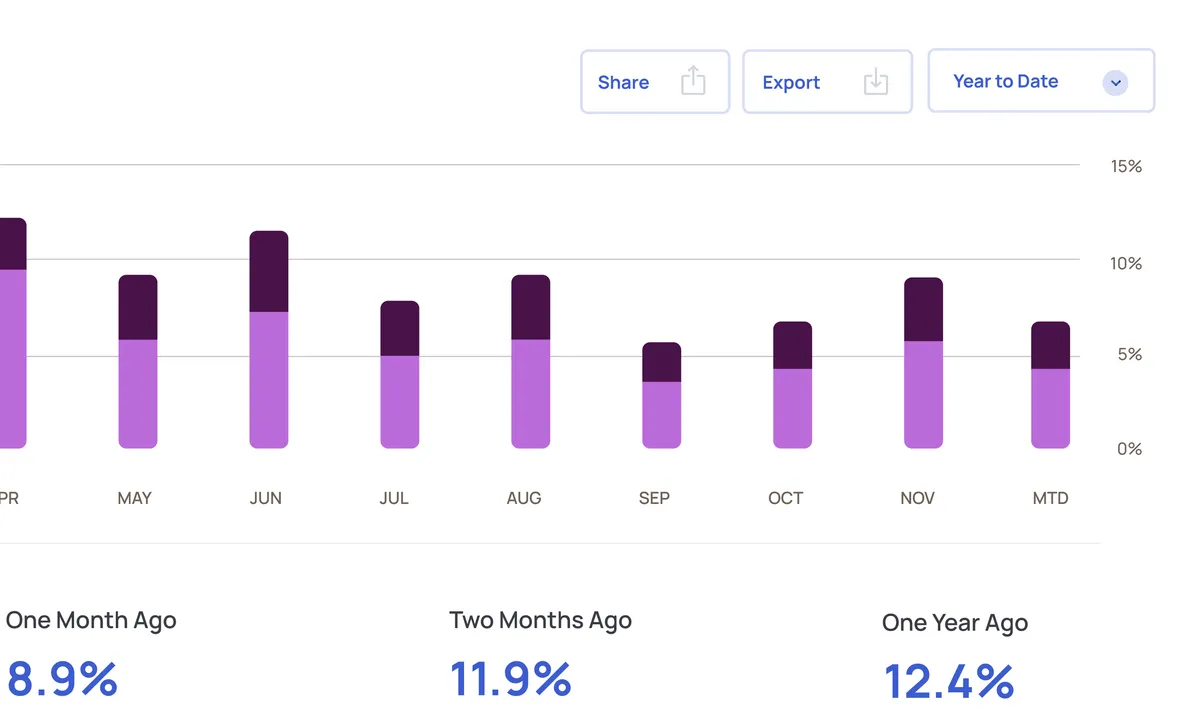

Clients benefit from clear, compelling metrics that demystify data, helping track boosted revenue, recovery rates, and more. The platform is praised for its user-friendly approach, enabling businesses to understand and implement retention strategies without the need for specialized expertise. Churnkey also manages accounts, providing a "set it and forget it" experience, allowing businesses to focus on product, growth, and customer satisfaction. Notable testimonials highlight the platform's impact, with users experiencing significant reductions in voluntary churn, increased customer lifetime value, and improved overall business performance. Churnkey's commitment to excellence positions it as a valuable partner in safeguarding and enhancing a company's revenue and customer base.